A highly relevant asset within the Madrid hotel industry under the umbrella of an international fund. In a strategic location and currently undergoing a process of transformation, GAT Management takes on the operation of the asset through an HMA to improve results by reviewing and redefining processes, updating technology, repositioning commercially, and expanding business capacity, having achieved in the first few months an increase in operating results of more than 60% compared to the previous year.

Hotel 4*, 378 rooms

(Madrid) 2021 – Present

Off-market opportunity with special needs, repair work and pre-opening completed in one month. Upgrade project for upgrade to five star in second year.

Hotel 3* 147 rooms

(Sierra Nevada, Granada) 2021 – 2023

A ‘loan to own’ operation by an international fund, Bain Capital, which has commissioned GAT Management to operate the asset via a variable lease agreement. The mission is to enhance the asset’s value through reconceptualization, reconfiguration of marketing and operation of the asset, deployment of Capex (phase I already executed), and achieving quantitative and qualitative results in the short to medium term. Leveraging the asset for sustained growth and an annual result with triple-digit increases.

Hotel 4* 182 rooms

(Antequera, Málaga) 2021 – Present

The process so far has included several milestones: identifying the opportunity, a full operational audit, the acquisition, the stabilisation of operations and the deployment of a €7M CAPEX. Currently divested in favour of Anchor Investor.

Hotel 4*. 204 rooms

(Huelva) August 2018 – Present

The Residences Islantilla: 254 rooms

(Huelva) November 2019 – September 2022

This was a loan to own operation in which an international fund, Farallon, bought the debt. The main achievements of the transaction have been the reorganisation of the entire resort and a CAPEX deployment of €9m (in a first phase). The resort employs more than 1,200 people and welcomes around 4,000 guests every day. Average annual sales are in excess of €45m.

(7 Hotels) 1400 rooms + 350 Apartments + 8 Leisure Parks + 40 Outlets + 7 Restaurants

(Oropesa del Mar) November 2020 – December 2022

This asset consists of a hotel, clubhouse, 27-hole golf course and the premium apartment complex (The Residences of La Sella). The process ranged from search and audit to the deployment of CAPEX of €6M. Currently divested in favour of Anchor Investor.

Hotel 4*. 186 Rooms (Denia) February 2018 – Present

The Residences La Sella: 104 Rooms

(Denia) February 2018 – September 2022

We acquired this asset through a “loan to own” operation from an international fund. Our process up to now has consisted of the restructuring of the personnel department, the deployment of CAPEX, and the reopening of the hotel. The average annual sales exceed 8 million euros. The divestment has been carried out with great success in revaluation.

Hotel 4*, 157 Rooms

(Formigal) June 2020 – 2023

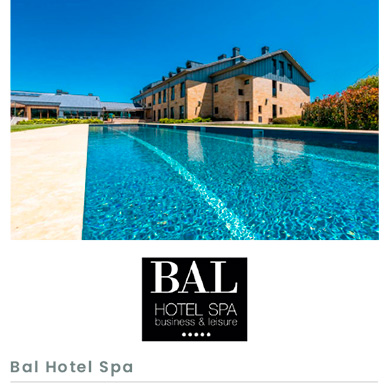

This asset was obtained through a “loan to own” operation involving four Spanish banks. The process involved: takeover, audit, business development and transformation of different areas. Sales increased from €1m to €8.5m.

Hotel 5* 64 Rooms +145 Apartments (300 acomodation units)

(Murcia) 2010 – March 2019

This asset was in a critical situation and we had to regulate various aspects of the business; the operations, management, marketing and merchandising of the hotel.

This asset was managed through a full management agreement until it was transferred to another operator. Average annual sales were in excess of 9 million euros.

Hotel 4*. 178 Rooms

(Guadalmina, Costa del Sol) November 2015 – March 2021

GAT advised on the acquisition of the asset and we entered into a long-term lease agreement.

Average annual sales exceeded 21 million euros.

City Hotel 4*. 313 Rooms

(Madrid) July 2015 – July 2019

This operation has consisted of the asset transaction from NH to a family office, in which the main tasks have been identification and auditing. Currently, in the process of divestment in favor of the Anchor Investor.

Hotel 4*, 106 Rooms

(Cádiz) July 2015 – December 2021

We acquired this asset through a “lown to own” transaction from an international fund. Our process so far has consisted of restructuring the staff department, deploying CAPEX and reopening the hotel. Average annual sales are in excess of €6M. The divestment has been very successful in terms of revaluation.

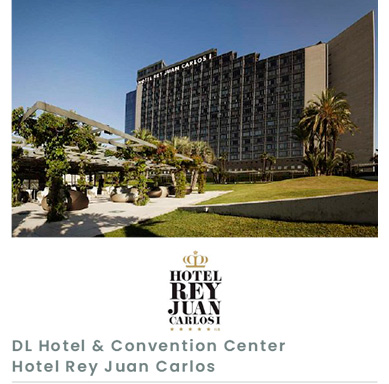

Hotel 5*. 434 Rooms + Conference Center

(Barcelona) July 2013 – October 2014

This asset belonged to Hispania. It was a full lease contract in which our main tasks consisted of the acquisition, reorganisation and marketing of the asset.

Average annual sales were in excess of €10m.

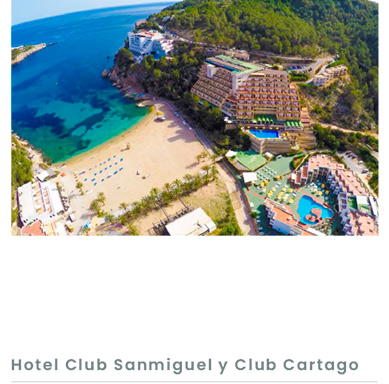

2 Hotels. 294 Rooms

(Ibiza) February 2017 – March 2019

We agreed a temporary lease with Banco Sabadell until the asset was acquired by a third party. Average annual sales were €3 million. It has been a success for the property and for its divestment.

Hotel 5*, 45 Rooms

(Gijón) 2014 – 2016

We participated in the opening of the hotel with a full interim management agreement. Average annual sales exceeded 6 million euros. Following its opening and successful stabilisation of operations, the divestment was completed.

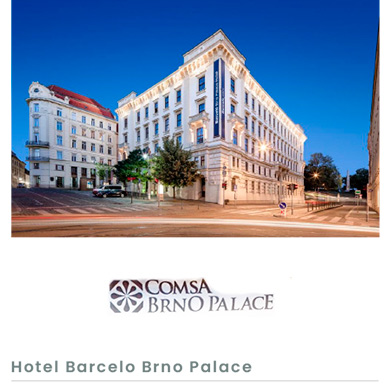

4-star Hotel, 119 Rooms

(Brno, Czech Republic) August 2009 – March 2012

Lease agreement with the property. The asset had been closed for 2 years and GAT reopened within a period of 3 months, the main objective was to start operating the asset in the summer season 2022. This asset consists of 45 beachfront accommodation units in Cabo de Gatas. The objective is to expand the accommodation units in order to revalue the asset and its subsequent divestment.

Hotel 4*, 45 Rooms + Development

(Cabo de Gata, Almería) 2022 – 2024

We agreed a temporary lease with Banco Sabadell until the asset was acquired by a third party. Average annual sales were €3 million. It has been a success for the property and for its divestment.

Hotel 5*. 58 rooms

(Badajoz) 2009 – 2011

We opened and marketed the senior resort, operating for a bank under a full management agreement. Average annual sales exceeded €4m.